Several factors affect how much you pay for auto insurance coverage. For instance, some of your car’s features can play a role. Some of its features that can affect your insurance rate include:

- Vehicle type: Your vehicle’s model and make can affect your insurance rates. For instance, sports cars and luxury cars are often more expensive to insure because they cost more to replace or repair.

- Vehicle age: Older cars are cheaper to insure because they aren’t worth as much as new models. They’re also cheaper to replace or repair. This rule doesn’t apply to every car. However, some newer models with advanced safety features are beating the odds.

- Engine size: Cars with large, powerful engines, like sports cars, are often more expensive to insure. Insurance companies see them as a higher risk since they are more likely to be involved in speed-related accidents.

- Safety features: Some policies grant insurance discounts to cars with safety features like anti-lock brakes, anti-theft devices, and airbags. These features reduce the vehicle’s risk of theft or injury, lowering the risk for the insurance company.

- Car size: Large cars are usually cheaper to insure than compact cars because they fare far better in accidents. On the other hand, SUVs and other extremely large vehicles are expensive to insure since they typically cause more damage.

- Likelihood of theft: Some cars are more attractive to thieves than others. If your vehicle is one that’s frequently stolen, there’s a chance you’ll have high insurance premiums.

- Cost of repairs and parts: If the parts on your car are expensive or rare, or if it’s costly to fix, your insurance rates will probably reflect that.

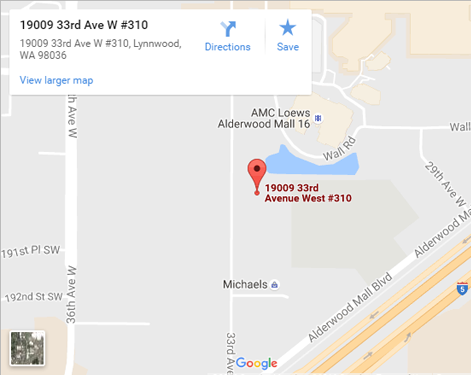

Paying attention to these guidelines is important, but you must also remember they are general trends. The exact impact on your insurance rates will vary based on your chosen insurance company and other factors like your driving history and where you live. If you live in Lynnwood, WA, it’s a good idea to contact your favorite local agent at Sound Choice Insurance Agency Inc. to ensure you get the best rate.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions