If you have a business, then you probably already know that you need commercial insurance. Many people, however, do not realize the terms and conditions may vary from policy to policy. Knowing what is covered is one of the keys to protecting your business from losses. For example, do you know if your commercial insurance covers inventory losses?

Inventory Losses

There can be a number of situations in which you may lose inventory and not all insurance will cover inventory losses, especially if it is perishable goods. This should be taken into consideration when purchasing your insurance. If you have a considerable amount of inventory, or you have products which may be damaged or even spoil, then you may need special coverage or a rider on a policy which helps you customize coverage to prevent gaps. Speak with your insurance agent about the ways you can protect your valuable inventory and create a better policy for your needs.

Finding A Good Policy

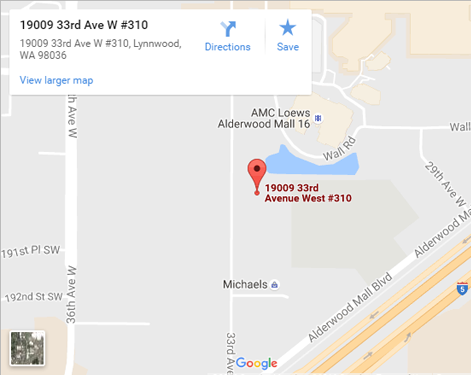

Finding a policy that works for you is easy if you have the right agent and insurance provider backing you. Make sure to do business with a reputable insurance company with knowledgeable agents who will work with you closely to make sure you are protected. Residents of the areas around Lynnwood, WA know that they can rely on Sound Choice Insurance Agency Inc to give them the information they need to make a wise decision when it comes to coverage.

Always keep adequate coverage for your inventory, especially if you are a growing company. Loss of inventory can cripple a business and lead to disaster. Work with the agents at Sound Choice Insurance Agency Inc in Lynnwood, WA to ensure you are protected from losses. Call or stop by today to get more information about insurance products to fit your needs.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions