Managing the Risks of Business Expansion with Upgraded Commercial Insurance

A business expansion project introduces new risks that could potentially result in financial loss. Learn how temporarily enhancing your commercial insurance policy could shield you as a business owner.

Protection for Commercial Tools and Equipment

Commercial tools and equipment are susceptible to damage during an expansion project. They could also be potential targets for theft while the project is in progress.

Adding extra protection to your existing policy can ensure the essential materials required to complete the expansion are covered. Your insurance policy should include any valuable items that are integral to your operations. If you need to file an insurance claim, your coverage will reimburse you for any out-of-pocket costs you’re responsible for.

Liability Protection

If you employ workers to perform upgrades at your business premises, it’s imperative to consider the risk of injuries. An active worksite can impose serious hazards.

Individuals working at elevated heights face the risk of falling. Injuries occurring on your property could result in lawsuits against you. Liability coverage shields you from bodily injury claims and also grants protection for any property damage occurring while the expansion project is in force.

You have the discretion to decide how much liability protection your commercial insurance policy offers. If you alter the expansion plans while the project is ongoing, you can also increase the amount of liability protection if necessary.

Insurance Agent Assistance

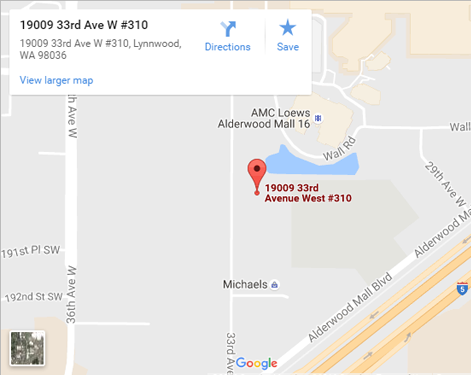

Never embark on an expansion project without the necessary insurance coverage. We advise consulting with an agent serving the Lynnwood, WA, area before starting. Feel free to contact our office and request to speak with one of our Sound Choice Insurance Agency Inc. agents. The agent will match you with suitable commercial insurance products.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions