It’s a beautiful country and the residents of Lynnwood, WA know that more than any other outdoor enthusiast. At Sound Choice Insurance Agency Inc. in Lynnwood, WA our knowledgeable staff of professional insurance agents will help you understand exactly how to best utilize your motor home insurance policy as the reassuring tool that it is. As you’re taking in the sights of beautiful Washington state and the surrounding areas you do not want to have to consider exactly what you’re covered for in case of a mishap or an accident. Motor Home Insurance is different from auto insurance in that it is protecting your motor home. However, the keyword is "motor". You will be driving this particular home. So, as a result, your motor vehicle record is taken into account including whether you have motor vehicle infractions. There are other factors that are taken into account when evaluating your risk for obtaining motor vehicle motor home insurance as well. Similar to your auto insurance coverage, a good motor home insurance agent will explain to you how the following factors affect your policy: the storage of the motor home, your gender, your marital status, your credit score, your driving experience and, your age.

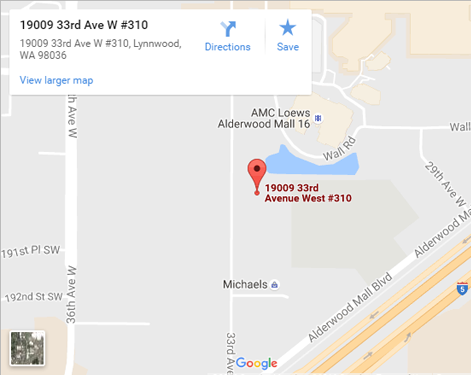

At Sound Choice Insurance Agency Inc our name speaks for itself. We are what makes sense in protecting you and your family when it comes to insurance. We serve the following states Washington, Alaska, Arizona, California, Colorado, Georgia, Idaho, Michigan, Montana, North Dakota, Nevada, Ohio, Oregon, and South Carolina. In addition to motor home insurance packages, we offer automobile insurance, home insurance, umbrella insurance, restaurant insurance, classic car insurance, renters insurance, condo insurance, flood insurance, business insurance and boat and watercraft insurance. We are located at 19009 33rd Ave. W. Suite 310 in Lynnwood 98036. If you prefer, call us today at 425–333-8033.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions