It’s summer and time to travel the world. But, before purchasing the plane tickets and reserving the villa you will be staying at your desired location, you better keep your home safe while on vacation. The data information shows July and August are the busiest months of the year for homes to be burglarized and the majority of the homeowners were away on vacation at the time of the break-in.

Precautions Inside The Home

To deter burglars from targeting your home, set timers for your interior lighting and television to go on periodically throughout the day and night. It’s the best approach to showing potential stalkers that someone appears to home at the time of their inquiry. Home invasion burglaries are crimes of fortunate opportunity with a zero chance of getting caught by the authorities.

If you have an automatic home security system, alert the company that you will be away from home on vacation for an extended period of time. This will give them ample time to assign an employee to monitor all activity from inside the home. However, to accomplish this, you must set the security system before leaving on your vacation.

Don’t Let Your Mail Pile Up Outside

A clear sign for burglars that no one is home is having your mail and delivery packages pile up on your front porch or inside the mailbox. This is one of the first signs burglars look for when canvassing neighborhoods as unattended homes are ideal to strike first. Your best option is having a neighbor collect your mail or alert the post office that you’re temporary stopping delivery until you return from your vacation.

Keep a Low Profile on Social Media

Never self-promote or advertise an upcoming vacation on your favorite social media sites. Plus, check all of your recent posts to make sure that you haven’t inadvertently placed your street address in the text. If so, then edit or remove the post altogether. Providing this information makes your home an easy target for burglars who are trying to gain access to online searches.

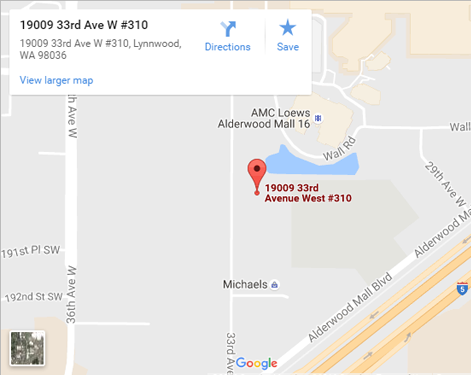

Before leaving Lynnwood, WA on vacation, contact Sound Choice Insurance Agency Inc on suggestions to keeping your home safe while you’re away.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions