Impaired drivers, distracted drivers, inexperienced drivers, uninsured drivers, bad drivers—yes, the list of worries, starting with other drivers on the roadways, is extensive. That’s why drivers from in and around the Lynnwood, WA, area rely on the professional and experienced team at Sound Choice Insurance Agency Inc. for all their auto insurance questions and needs.

Don’t Let Worry Keep You from Driving with the Right Protection

We might be surprised to discover how many people combine errands into one trip to avoid driving as much. Yes, some make those decisions to save time or money, but many drivers also make those decisions based on their concerns about spending more time behind the wheel and on the roads.

The good news is that with the right auto insurance solutions, drivers can worry less and drive more with the assurance and protection auto insurance can provide. That’s why Lynnwood, WA area drivers turn to the trusted, professional, and friendly team at the Sound Choice Insurance Agency for all their auto insurance solutions.

Auto Insurance Solutions and Protection for Lynnwood, WA Area Drivers

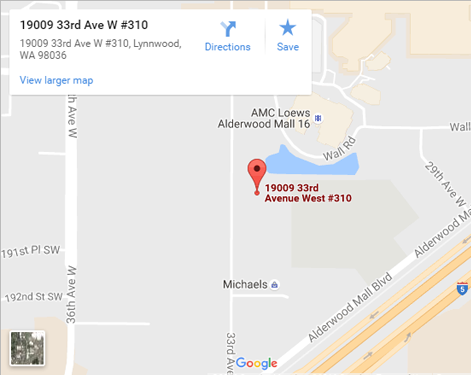

If you live or drive in the Lynnwood, WA area and need auto insurance for your vehicle, we can help. Contact us to find out more, and for the protection and peace of mind, you need and deserve with the right auto insurance solutions at the Sound Choice Insurance Agency Inc. today.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions