When you finance a new or used car, you’ll be asked about adding gap insurance to your monthly payment. While you might be inclined to say no, it’s important to understand what gap insurance is and how it can be beneficial for you.

What is Gap Insurance?

Also known as guaranteed asset protection, gap insurance steps in if your car has been stolen or totaled and the value that you owe is more than what the car is worth. They will pay the difference in the loan for you, so you aren’t forced to continue paying on a loan for a vehicle you no longer have. It will usually add between $10 and $20 to your monthly payment if you decide to add it to your policy.

Did You Add a Down Payment?

Most people use the down payment as a guide to determine if gap insurance is required. If you did not put a down payment on your vehicle when it was financed, then gap insurance is needed for your loan. In the event of an accident, you would have financial coverage to cover the difference in the loan.

If you put up to $5,000 down on your car, you should probably still get gap insurance since there is still a chance that you could be upside-down on the car’s value. You don’t need gap insurance if you put down more than $5,000 on your vehicle. Should something happen while you’re driving the car, you’ll likely already have the difference paid down through the down payment.

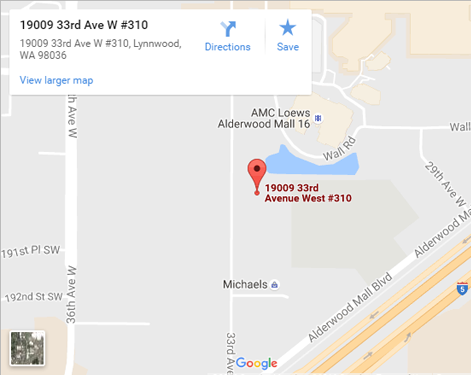

If you are interested in a personal auto loan quote, contact our agents at Sound Choice Insurance Agency Inc today for more information. We offer services for customers in the surrounding area of Lynnwood, WA.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions