Your home is likely one of your largest investments financially, and it is definitely one of your most important investments emotionally. Your house is where you and your family spend time and make precious memories. You want to do everything you can to protect your home. One of the most important ways you can protect your home is by having sufficient home insurance. At Sound Choice Insurance Agency Inc serving Lynnwood, WA we love helping our clients make sound insurance choices. Keep reading to learn more about shopping for new home insurance.

Why Should I Shop For New Insurance?

Most people think that if they have an insurance policy in place, then why should they ever shop around for a new one? The truth is circumstances change over time, and your insurance policy may not be reflecting those changes. When your policy is not updated periodically it can cause you to be spending money on things you may no longer require, or you may find yourself underinsured. Either way, this can put your home in a vulnerable position.

When to Shop for New Home Insurance

Home insurance needs will change along with your home. If you have made any major improvements to your home, this will increase the value of the home. When the value of the home is increased, the amount of insurance coverage must increase as well. If changes have been made to your home or property which would increase your risks of liability, your insurance policy should be updated to reflect this as well. In order to understand all of the ways your insurance needs may have changed, it is best to sit down with an insurance representative to discuss such changes.

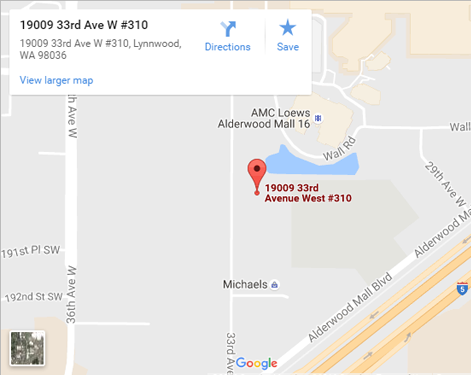

If you would like to learn more about home insurance, please call our staff today at Sound Choice Insurance Agency Inc, serving Lynnwood, WA.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions