Purchasing your first home is one of the most pivotal moments in anyone’s life, but it can also be stressful and overwhelming. From having to pick a mortgage lender, to do an inspection and appraisal, to the actual closing home buying is both exciting and nerve-wracking. Luckily for you, we can make that process a little bit easier by continuing to read our first-time homeowners guide to home insurance.

Although home insurance isn’t mandated by states, it is going to be required by your lender if you are financing the house purchase with a mortgage. If you are purchasing your home in cash, homeowners insurance is not required, but it is highly recommended to protect your investment. When comparing policies, it is important to pay attention to your deductibles. When choosing a policy, keep in mind that whatever deductible amount you select for coverages like the personal property you must pay that first before your insurance kicks in.

Additionally, you want to select a policy that has adequate liability and personal property coverage. Liability coverage protects you if another person is injured while on your property and you are found to be liable. You’ll want to have a liability limit that covers your total assets. Conversely, if you own expensive artwork or furniture than having higher coverage for personal property will help protect these items from loss.

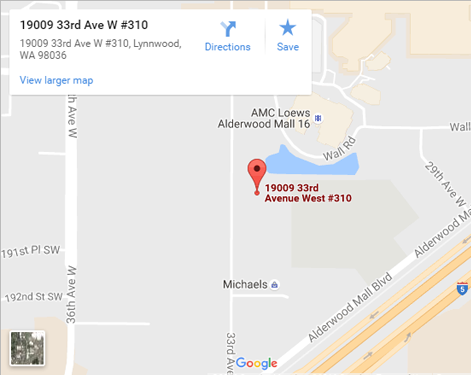

At Sound Choice Insurance Agency Inc. in Lynnwood, WA our talented and friendly team of insurance experts are ready and willing to assist in helping you find the perfect homeowners insurance policy for your needs. Give us a call today to schedule a no-obligation consultation with one of our team members.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions