Commercial insurance works to protect your business in Lynnwood, WA from financial ruin in the instance of the unexpected happening. You should understand the tenets of a good assurance plan before you need to take advantage of its benefits. Unfortunately, though, many business owners do not give enough credence to commercial insurance and, thus, find themselves in a bind when tragedy strikes and policy limits leave them with outstanding balances.

The agents at Sound Choice Insurance Agency Inc work to get your company fully protected so that you are ready when the unthinkable manifests. Read on to learn about commercial insurance policy limits and how much assurance your business may need!

What are commercial insurance policy limits?

Your business assurance plan in Lynnwood, WA is not absolute. Just as with a car insurance policy that imposes maximum limits for payouts, so also does your commercial indemnity plan. The amount of compensation you receive from your policy after tragedy strikes largely depend on your premium. Those who pay higher amounts for coverage may find that their policy pays for more damages that those who pay the bare minimum in premium amounts every month.

Bigger, however, is not always better. Some business owners find that they do not have the protection they need even with high monthly premiums. It is important, then, to discuss the nature of your business with a specialist from Sound Choice Insurance Agency Inc to ensure that your indemnity plan is the right one for your situation.

How much commercial insurance do you need?

The amount of business assurance your company needs depends on the type of business that you carry out during the day. Those with retail companies may find that they need more coverage for incidents because of the flow of customers throughout the workday. Meanwhile, those with Internet-based companies may not need as much assurance in the way of physical liability. It may be essential, however, to have an indemnity plan that pays for lawsuits related to intellectual property.

An agent at Sound Choice can help you navigate the way of commercial insurance. Call them today for a consultation and to get started with a quote!

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

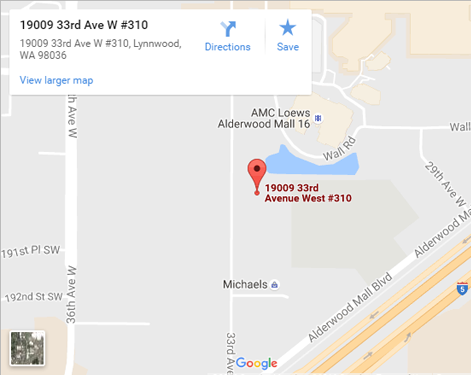

Get Directions